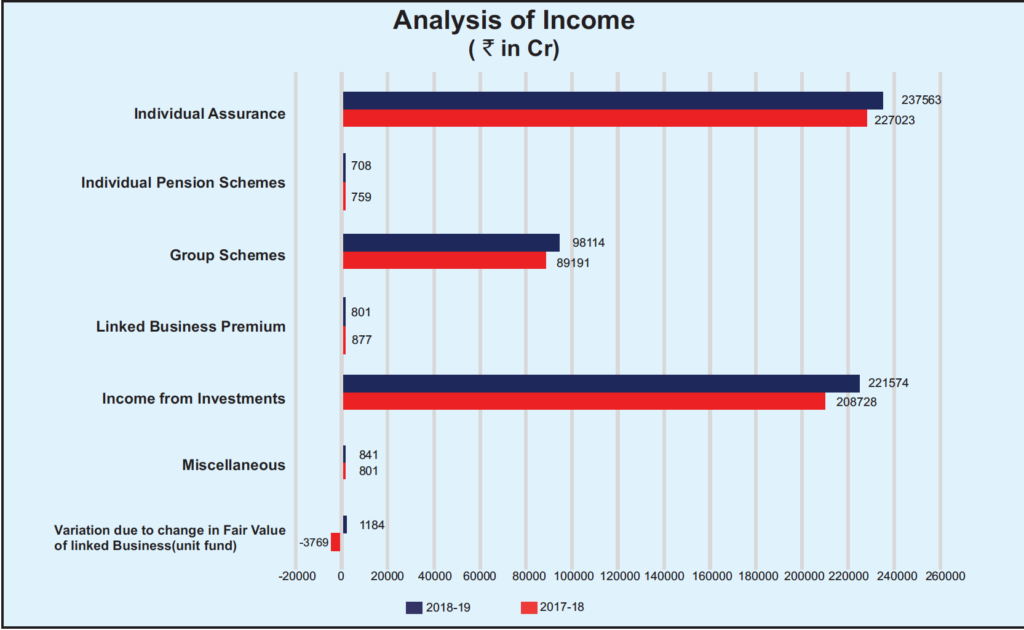

The total income of LIC which includes total premium and investment income was around Rs 560784 crore in 2018-19 a rise of 710 per cent. During the financial year 2018-19 the life insurance industry reported a profit after tax of Rs 8435 crore as against Rs 8511 crore in 2017-18.

Lic Business Analysis The Financial Pandora

At the end of FY 2018-19 it jumped to Rs 226 lakh crore.

Fyp – 2018-19 (rs. crore) of lic. And Prudential plc 1 Angel Court London EC2R 7AG United Kingdom Investment Manager. The housing finance company had posted a standalone net profit of Rs 59434 crore for the corresponding period of 2017-18 fiscal. When Modi govt came to power LICs cumulative investment in public sector was Rs 119 lakh crore.

The national insurer Life Insurance Corporation of India LIC has registered a 1346 percent increase in first time premium income FYP. The Annual Report and the Notice of AGM is also uploaded on the Companys website www sbilifeco. 564 crore in FY 19-20 as compared to Rs.

LIC Housing Finance on Saturday reported a 1670 percent growth in net profit at Rs 69358 crore for the March quarter of 2018-19. The total revenue of the company for the FY 2018-19 is Rs 805927 cr as against Rs 908305 cr. The life insurer earned a total premium of Rs 29186 crore in 2018-19 compared to Rs 23564 crore in the last year registering a growth of 24 per cent.

15 of the Income Tax where. Supported fy 2018-19 32 cumulative sanctions since inception 349 lakh crore cumulative disbursements since inception 335 lakh crore disbursement during fy. Crude oil price has been on the rise since January March 2019 quarter and is expected to remain volatile due.

In You are requested to take note of the above and arrange to bring this to the notice of all. Total income rose to Rs 4655 crore during the fourth quarter from Rs 3887 crore in. Out of the twenty-four life insurers in operations during 2018-19 twenty companies reported profits.

Such a robust income augurs well for the corporations policyholders who can continue to expect a decent bonus for 2018-19. NLCILs revenue dipped to Rs 102378 cr in the FY 2018-19. Individual non single premium increased by 587 in 2019.

National insurer Life Insurance Corporation has registered a 1346 per cent rise in first-year premium FYP income collecting an all-time high income of Rs 13455168 crore in FY18 and ending the year with a market share of 6940 per cent the company said today. State-owned LIC on Friday paid a dividend of Rs 261074 crore to the government for financial year 2018-19. The companys total income increased to Rs.

LIC had mobilised a total new premium of Rs 4108631crore in FY19. LIC of India collected a premium of 14219169 crores in 2019 whereas the premium collection for the year 2018 was 1345568 crores. LIC India AUM grew 924 last fiscal.

Landmark Race Course Circle Vadodara 390 007 India. Friday 31 May 2019 PNS New delhi. According to the Central Statistics Office CSO the Indian economy grew at 68 in FY 2019 compared to 72 in FY 2018 on the back of slowdown in private consumption.

However the amount of Income Tax and Surcharge shall not increase the amount of income tax payable on a taxable income of 50 lacs by more than the amount of increase in taxable income. Annual Report of the Company along with the Notice of AGM for the FY 2018-19 which is being despatched I sent to the members by the permitted modes. 26 April 2018 Last Updated at 812 pm Source.

It had annual income of Rs 561 lakh crore and achieved the highest ever First Year Premium Income of Rs 14219169 crore in 2018-19 it said. SBI General Insurance today announced its financial results with a Net Profit of Rs 412 crore and Gross Written Premium GWP. LIC India accounts for 78 of the total AUM of life insurance industry with assets of Rs2761 lakh crore.

The LIC of India reported a profit after tax of Rs 2688 crore. ICICI Bank Limited Regd. LIC has completed 63 years since its incorporation and now manages assets worth more than Rs 3111 lakh crore.

2018-19 55315 crore gross npas in retail loans at 114 eps 4817 per share. It has a market share of 7628 in number of policies and 71 in First year Premium as on. The renewal premium accounted for 5768 per cent of.

This calculator is applicable for Finance Year 2018-19. Individual single premium reduced by -83 in 2019 but the group non single premium increased by a whopping 6632. 10 of the Income Tax where taxable income is more than 50 lacs and upto 1 crore.

ABRIDGED ANNUAL REPORT FOR F. AUM of ULIPs increased to Rs411 lakh crore in FY 2018-19 from Rs377 lakh crore in FY 2017-18 marking a growth of over 9. ICICI Prudential Asset Management Company Limited Corporate Identity Number.

State-owned Life Insurance Corporation of India LIC has reported a growth of 29 per cent in its net profit at Rs 2614752 crore in FY18 said Shiv Pratap Shukla Union Minister of. TMC Punjab CM Attack Centre Over Extension Of BSFs Jurisdiction By. According to the latest Annual Report of Life Insurance Corporation of India LIC ahead of its proposed IPO the non-performing assets NPAs as of March 31 2021 are Rs 3512989 crore out of a total.

470 crore in FY 18 -19 Photo. During 2018-19 it has paid 259 crore claims for an amount of Rs 163 lakh crore. The Life Insurance Corporation LIC ahead of its initial public offering IPO has improved its asset quality for the financial year which ended March 2021.

The Profit Before Tax PBT stood at Rs. LICs FYP income jumps 135 to record Rs 134 tln in FY18. During the Financial Year 2018-2019 LIC generated a valuation surplus of Rs 5321441 crore registering a growth of 99 over the previous year.

During 2018-19 Life Insurance Corporation of India LIC recorded 606 per cent and private sector life insurers posted 2137 per cent growth.

Lic With Adhar Card Publications Facebook